Newbies

Get started fast with guided onboarding, tutorials, and strategy templates so your first bot is ready in minutes.

Institutional-grade algorithmic strategies. Backtested, monitored, and adjustable — scale from a single account to enterprise deployments.

From hobbyists to HFT pros — RAISN gives every trader an AI assistant they can trust.

Get started fast with guided onboarding, tutorials, and strategy templates so your first bot is ready in minutes.

Fine-tune bots with indicator banks, regime-aware overlays, and advanced risk controls for tighter performance.

Manage multiple client allocations, bulk deployments, white-label dashboards and automated performance reporting.

RAISN Model Portfolio

All performance information below is gross of fees. Performance is based on live trading of the strategy. Figures are taken from native broker reporting. Performance is updated after the end of each month.

| Period | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | / | / | / | / | / | / | / | / | / | ||||

| 2024 | |||||||||||||

| 2025 | / | / | / | ||||||||||

| Cumulative | |||||||||||||

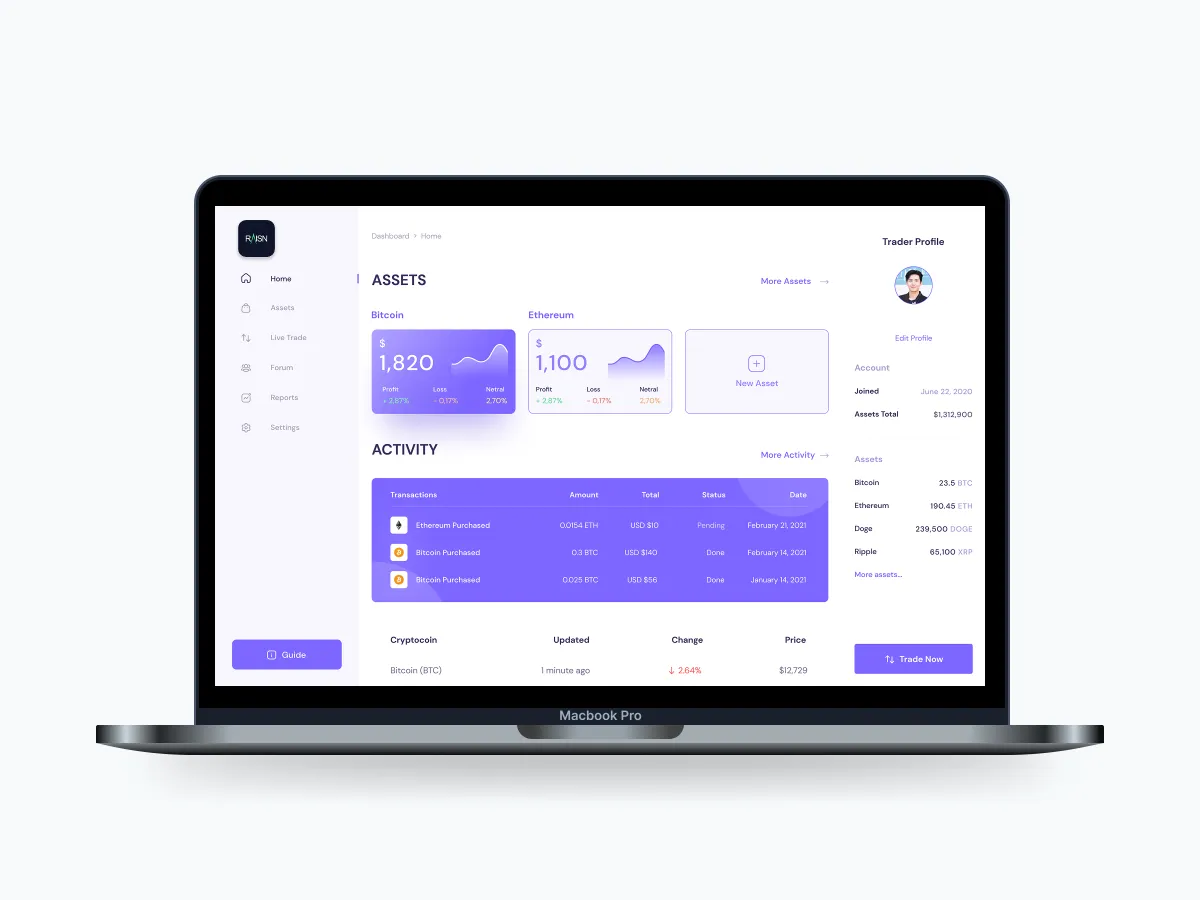

Open your Raisn account. We're here to assist at every step.

Customise your bots' parameters or let our ready-made strategies trade for you. Define your goals and let automation take over

Sit back while your bot handles the trades, watches the markets, and does all the lifting for you. 24.7, non-stop.

Built for trend & counter-trend markets — ensemble rules with regime-aware switching.

Dynamic exposure management — volatility scaling, daily stop limits and drawdown controls.

Multi-subsystem rule engine combining signal ensembles, filters and portfolio allocation logic.

Supports BTC, ETH and major exchanges — deploy the same strategies across spot and derivatives.

Live-tracked performance with verifiable audit trails (Myfxbook or independent providers).

Low-touch deployment with managed risk and automated execution — set it and monitor.

RAISN offers a mix of ensemble ML + rule-based strategies tuned for different regimes. Below are example categories:

Trend (momentum) — volatility-aware breakout and trend-following portfolios with volatility scaling.

Liquidity & Microstructure — high-frequency oriented signals designed for low-latency execution (enterprise tier).

Mean Reversion — short-term reversion strategies with tight position sizing and stop controls.

Volatility Arbitrage — strategies that exploit changes in implied vs realized volatility.

Outstanding Gain: Achieve +54.23% profit growth in just a few months!

Robust Performance: Enjoy consistent monthly returns averaging 12.83%.

Dynamic Charted Success: See your equity climb—backed by real stats, transparent progress, and zero withdrawals!

Precision Trading: Advanced automated strategies keep drawdown confidently managed at 28.2%, ensuring steady account growth.

Strong Foundations: £10,500 in deposits, now at £14,204.90 balance. Your capital works harder for you!

Active, Data-Driven Approach: Daily performance updates, professional execution, and full visibility on every trade.

£199

1 Live Account License

Unlimited Demo Licenses

Unlimited Support

Free Updates for Life

Easy Installation Process

High Preformance Settings

£249

Dedicated Account Manager

2 Live Account Licenses

Unlimited Demo Licenses

Free Updates for Life

Easy Installation Process

High Performance Settings

Explore Our Common Queries and Solutions

RAISN supports FX, commodities, select equities, and major crypto pairs. Execution options include MT4/MT5, native exchange APIs, and FIX for enterprise clients.

Risk management is built-in: adaptive position sizing, volatility-scaled stops, daily loss limits, and portfolio-level allocation constraints. You can set a risk profile per account and pause strategies at any time.

We run automated kill-switches and daily risk checks. During extreme market events we have pre-defined escalation protocols, and enterprise clients can opt into additional protection and manual oversight windows.

We offer a 14-day trial for new Pro accounts. Enterprise onboarding is quoted. Trials are subject to terms and may require a verification step.

Instantly!

Check your email (and junk) for your registration link. A member of our team will be in touch to help you get started.

We aim for a realistic 4-9% a month.

Unlike a lot of websites in the industry, we aim to provide realistic growth. The gains do depend on market conditions, so nothing is guaranteed.

Any MT5 broker is compatible.

However, we recommend using Aeron Markets, as you'll be assigned a personal account manager.

© 2026. Raisn. All rights reserved.

Privacy Policy

Terms of Use