Cheap Stock or Deep-Value Mirage?

Cheap Stock or Deep-Value Mirage? Uncovering the Truth Behind Molina Healthcare

Deep-value investing is a simple yet complex concept. It involves buying businesses at prices far below their true worth, but sometimes, things get complicated. The main issue in these scenarios boils down to conviction. In this article, we'll explore the case of Molina Healthcare (MOH) and whether it's a cheap stock or a deep-value mirage.

Introduction to Molina Healthcare

Molina Healthcare is a holding company that owns health-plans across the US, providing medical cover to people enrolled in government programs such as Medicaid, Medicare, and the AFC Marketplace exchanges. The business operates like an insurance company, receiving premiums for each member and distributing pay-outs for medical care.

The Revenue Model

The revenue model works as follows: Government agencies pay a fixed amount per member, per month, determined by actuaries and adjusted for factors like age, health status, and other benefits. Molina then uses this money to arrange and pay for each member's care. The premium fees are regularly adjusted to ensure they cover real-world expenses. This is the main economic engine of the business.

Why It's Cheap

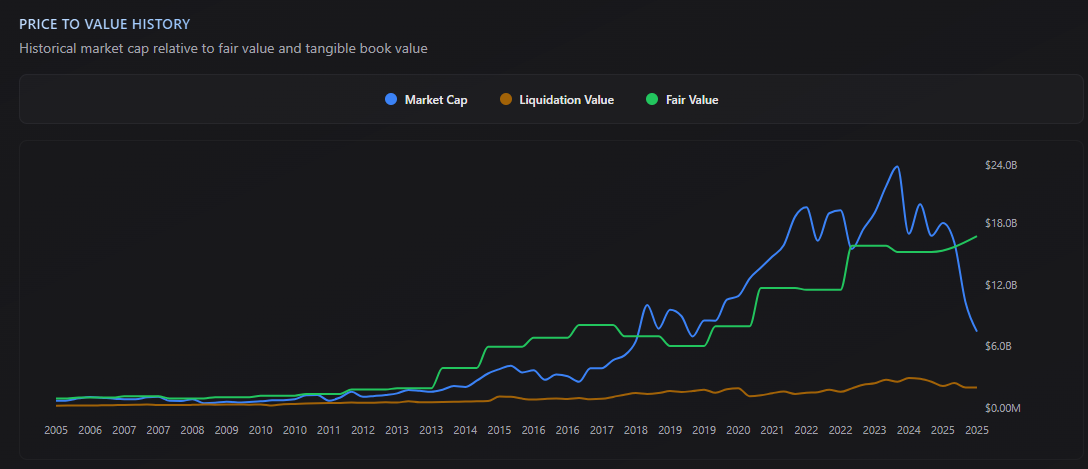

The stock price has fallen from $400 to $137 over the last two years, due to general negativity surrounding healthcare stocks in the US and the business itself suffering from higher costs, lower margins, and management cutting guidance.

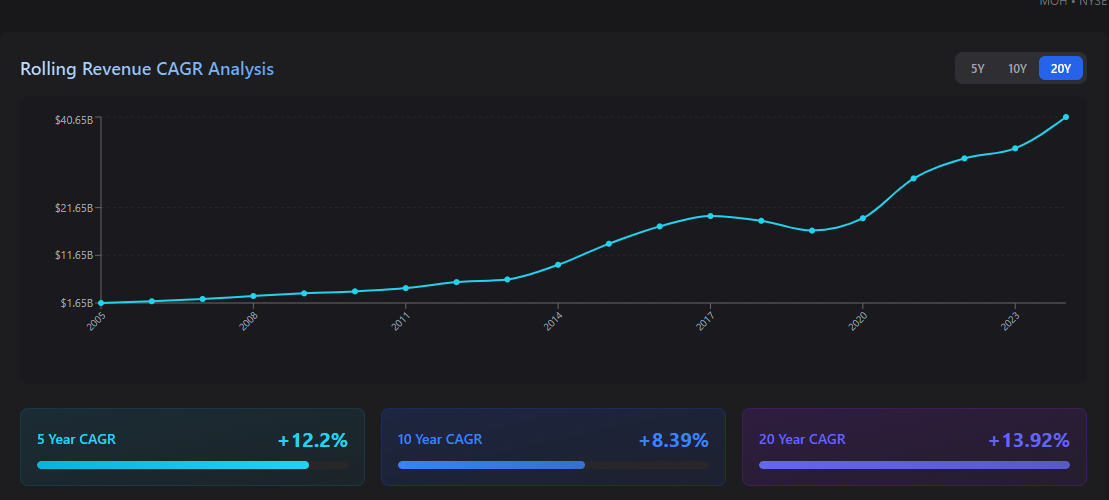

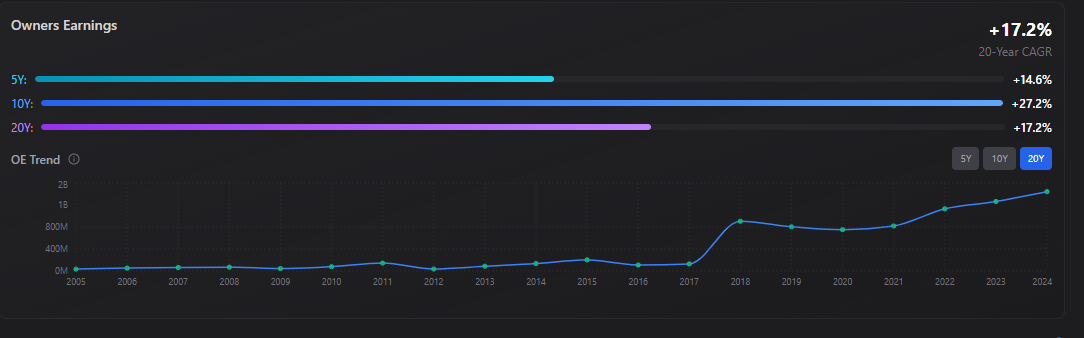

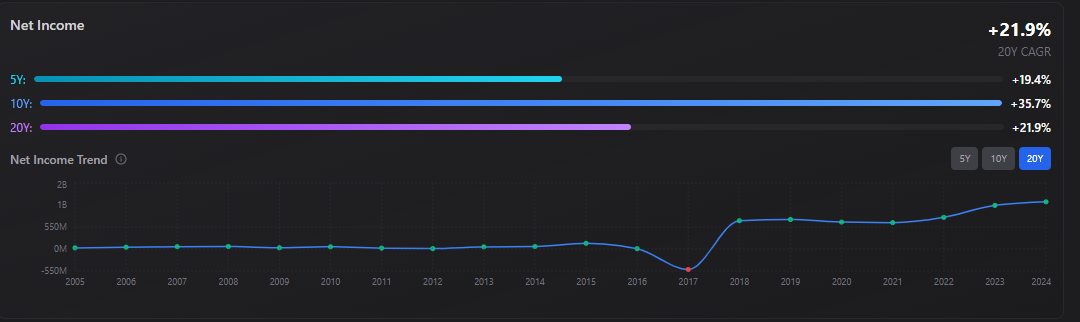

Despite this, the business has impressive earnings power, with 90% of years throwing off positive FCF, and has grown significantly over the last few years.

Key Ratios

Here are the headline ratios:

NCAV Ratio = 7

TBV Ratio = 4

EV/5Y FCF Ratio = 1

P/5Y FCF Ratio = 5

These ratios indicate that the business may be undervalued.

The Risks

There are several risks to consider, including:

Medical cost-trends running higher, squeezing margins

Procuring contracts, with a few big state contracts driving revenue

Political risks, with policy changes or regulatory changes impacting the business model

These risks are inherent in the business model, but management views them as temporary and is working to mitigate them.

The Investment Case

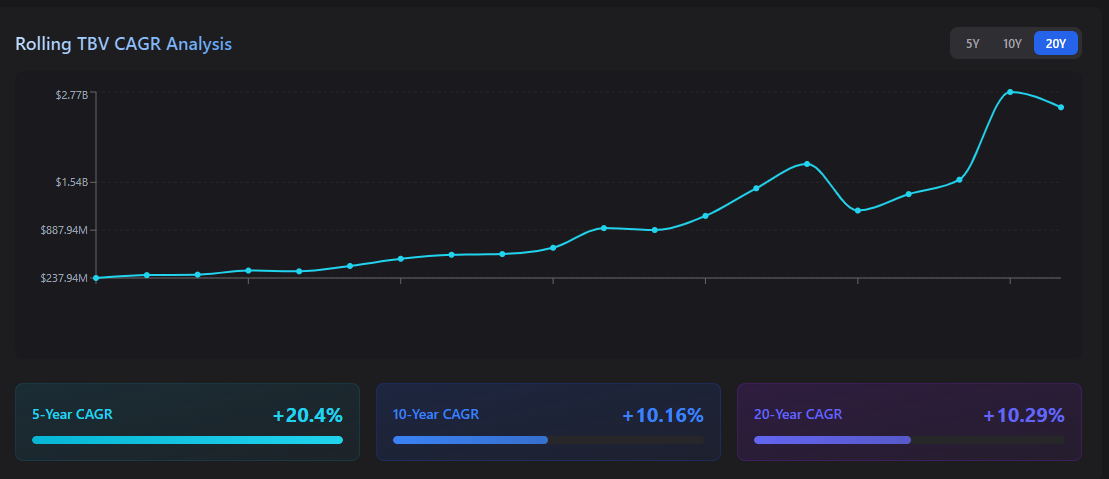

Molina Health is a solid business with good management, growing revenues, and increasing tangible asset value. Management believes the issues they face are temporary and will stabilize in 2026.

Despite the risks, the business may be a good investment opportunity for those comfortable with insurance businesses.

Conclusion

Molina Healthcare may be a cheap stock, but it's not without its complexities. The business has impressive earnings power, but the cash is restricted, and the regulatory environment is uncertain.

As an investor, it's essential to carefully consider the risks and rewards before making a decision.

With the right perspective, Molina Healthcare could be a valuable addition to a portfolio.

However, it's crucial to approach this investment with caution and thorough research.

Call to Action

If you're interested in deep-value investing and want to learn more about Molina Healthcare, subscribe to our newsletter for regular updates and analysis. Our expert team will provide you with the insights you need to make informed investment decisions. Subscribe now and start building your portfolio with confidence.

Talk to one of our experts about how you can make the most from Raisn!