3.8x FCF And Priced at 0.6x TBV

Unlocking Hidden Value: A Deep Dive into NanoRepro's Asymmetric Opportunity

As a private business owner, making investment decisions becomes much simpler. I've always been cautious of "tech stocks" with inflated valuations, instead opting for investments that offer downside protection and a clear path to growth. Today, I want to share with you a compelling opportunity that fits this criteria: NanoRepro, a German-based manufacturer of at-home diagnostics tests. With a current stock price that's trading below its liquidation value, backed by cash and investment stakes in profitable businesses, and zero debt, this company presents an intriguing case for investors.

Understanding the Business

NanoRepro's products include testing kits for various health indicators, such as pregnancy, ovulation, and menopause, as well as detection kits for food allergies and intolerances. They also offer liquid supplements for beauty therapies and male fertility. The company sells its products through retailers, online and offline, and has a growing presence in the B2B market, supplying medical clinics, hospitals, and professional web shops.

Valuation Metrics

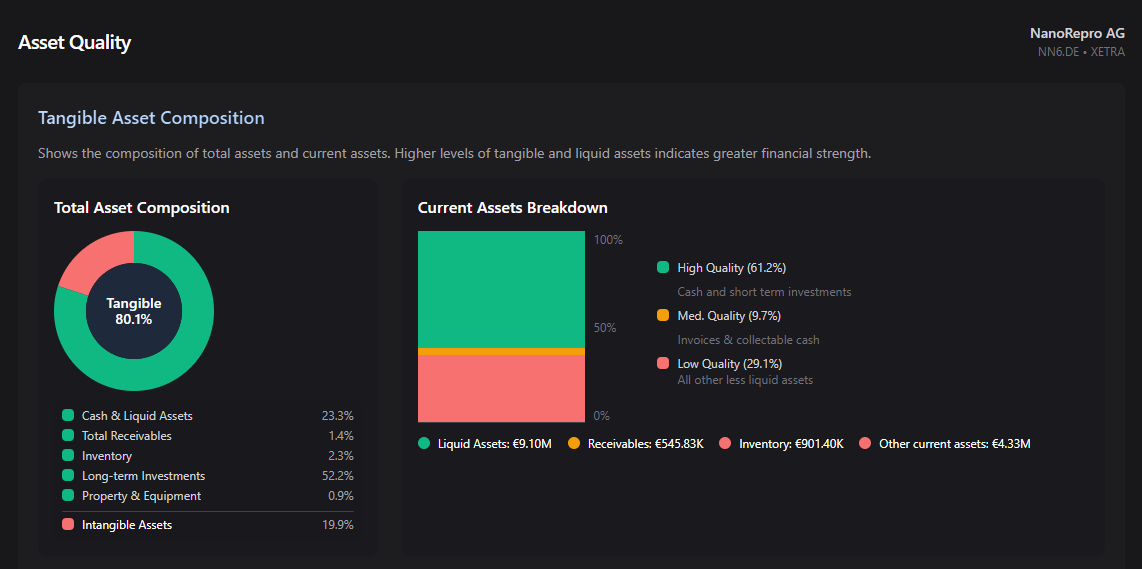

A closer look at NanoRepro's valuation metrics reveals an attractive opportunity:

NCAV Ratio = 1.5

TBV Ratio = 0.6

EV/5Y FCF Ratio = 3.8

P/5Y FCF Ratio = 6.5

These metrics indicate that the company is undervalued, with a significant margin of safety for investors.

The COVID Windfall and Its Aftermath

NanoRepro's revenue experienced a significant boost during the COVID-19 pandemic, reaching €162.7m in 2020-2021. Although the company's revenue has since decreased, it's essential to look beyond the surface. The COVID windfall has set the stage for structural growth, with non-COVID revenues almost quadrupling. The company has made strategic decisions, such as partnering with retail chains and expanding its product range through acquisitions.

Growth Pillars

NanoRepro's growth strategy is built on two pillars:

White-label partnerships with retail chains, allowing for instant scale-up and increased volumes

Inorganic growth through acquisitions, expanding the product range and broadening the company's presence in the health and beauty space

These pillars have the potential to drive significant growth, and the company's progress so far is encouraging.

Risks and Challenges

While NanoRepro presents an attractive opportunity, there are risks and challenges to consider:

Regulatory risks, particularly the IVDR approval process

Execution risk, as the company needs to sustain its progress and return to profitability

General business risks, such as supply chain disruptions, competition, and economic uncertainty

However, the company's disciplined management team, led by a CEO with over 20 years of experience, and its cash-rich position, mitigate some of these risks.

The Investment Case

In my view, the chances of NanoRepro succeeding with its plans are high. The company has already made significant progress, and its growth pillars are in place. With a strong management team, a solid balance sheet, and a clear path to growth, NanoRepro presents an asymmetric opportunity for investors.

If you're looking for a value investment with a significant margin of safety, NanoRepro is definitely worth considering. With its unique position in the at-home diagnostics market, growing presence in the B2B space, and strategic growth pillars, this company has the potential to deliver strong returns for investors. Don't miss out on this opportunity to unlock hidden value. Subscribe to our newsletter to stay up-to-date on the latest developments and investment insights.